The Shifting Landscape of Diamond Investment

The world of investment is ever-evolving, and diamonds have always held a unique allure. However, industry experts are increasingly sceptical about the viability of diamonds as a profitable investment. Unlike standardized assets, diamonds are non-fungible and lack a robust secondary market, making them difficult to sell.

The Historical Context and Recent Trends

Diamonds have historically not been favoured as an investment asset class. During the pandemic, a downturn in other asset classes like real estate and equities temporarily boosted demand for diamonds. However, this trend has reversed. The market is now experiencing falling demand and oversupply, which has driven down diamond prices. After peaking in February 2022, rough diamond prices have declined, depreciating by 13-15% over the past five years. This depreciation, combined with the lag effect on polished diamond prices, renders diamonds less attractive as an investment option.

Comparative Investment Returns

Recent data highlights the underperformance of diamonds compared to other investment vehicles. For instance, an investment of Rs.1 lakh in the Sensex in January 2023 would have grown by 25% to Rs.1.25 lakh by May. The same amount invested in gold would have returned 23%, increasing to Rs.1.23 lakh. Conversely, an investment in rough diamonds would have resulted in a 20% loss, reducing the investment to Rs.80,000. The lack of a liquid secondary market further diminishes the appeal of diamonds as an investment.

Emotional Value vs. Investment Value

While diamonds may not be the best financial investment, they hold significant sentimental value for many. Consider the example of a software engineer from Gurugram who recently purchased a diamond pendant for her daughter. For her, the purchase was driven by emotion rather than investment potential. This distinction is crucial when buying diamonds; understanding whether the purchase is for consumption or investment can influence decision-making.

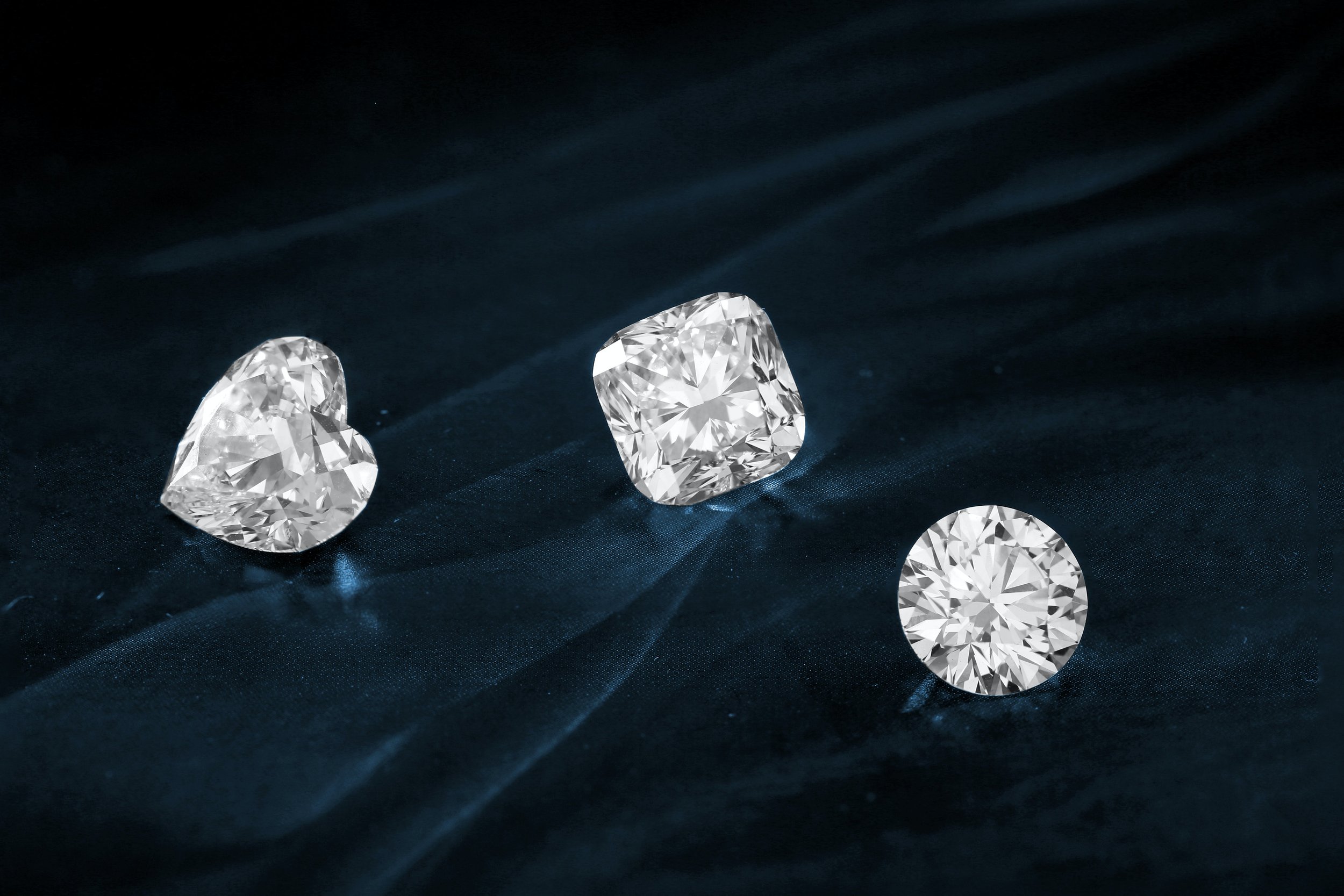

The 4 Cs and High-End Investment Diamonds

For those considering diamonds as an investment, it's important to understand that not all diamonds are created equal. The value of a diamond is determined by the 4 Cs: carat, cut, clarity, and colour. The most valuable investment diamonds are D-Flawless diamonds over 5 carats and high-quality, fancy-coloured diamonds like pink, blue, and sometimes yellow. However, acquiring these diamonds at the right price and ensuring their provenance is critical for investment purposes.

The Rise of Lab-Grown Diamonds (LGDs)

The diamond market is also facing disruption from lab-grown diamonds (LGDs). These synthetic gemstones are virtually indistinguishable from natural diamonds but are available at a fraction of the cost. Factors such as affordability, sustainability, and similarity to natural diamonds have driven a surge in demand for LGDs, particularly in the 1-3 carat segment. This shift is altering the consumption pattern of diamonds.

Despite their lower cost, some buyers, like the aforementioned software engineer, prefer natural diamonds for their rarity and perceived long-term value. She believes that mass-produced lab-grown diamonds lack the unique value proposition of natural diamonds.

Diamonds as an Exotic Investment

Investing in diamonds remains a niche activity, suitable primarily for wealthy individuals seeking exotic ways to diversify their portfolios. As global diamond analyst Paul Zimnisky notes, diamonds should be considered alongside art collections and exotic cars—complex investment options best left to experts.

In conclusion, while diamonds may hold sentimental value and aesthetic appeal, their viability as an investment is limited. The market trends, comparative returns, and the rise of lab-grown diamonds suggest that prospective investors should approach diamond investment with caution and a clear understanding of the market dynamics.