Navigating the Essential and Evolutionary Phases of Digital Transformation

In recent years, the banking and capital markets (BCM) sector has experienced a profound transformation driven by technological advancements, evolving customer expectations, and regulatory demands. This transformation will continue to accelerate over the next five years. The journey ahead includes developing digital operating models to align with the modern customer experience, a relentless focus on cybersecurity, advanced identity management, and a commitment to sustainability. Furthermore, this transformation will reshape hiring practices to ensure BCM companies can access the talent needed to thrive in the future. Those embracing this period of change, mainly retail and commercial banks, will be well-positioned for future success.

Rising expectations mark the contemporary customer experience for personalization and efficient transaction processing. To meet these demands, financial organizations are increasingly exploring technologies such as generative artificial intelligence (GenAI) and machine learning (ML) to enhance customer care and internal operational efficiency.

However, more than convenience is required if delivered equally and aligned with customers' interests and values. In this sector, trust is paramount, and any damage to it can have long-lasting repercussions. Companies must tread carefully, ensuring that new technologies are effectively planned and implemented.

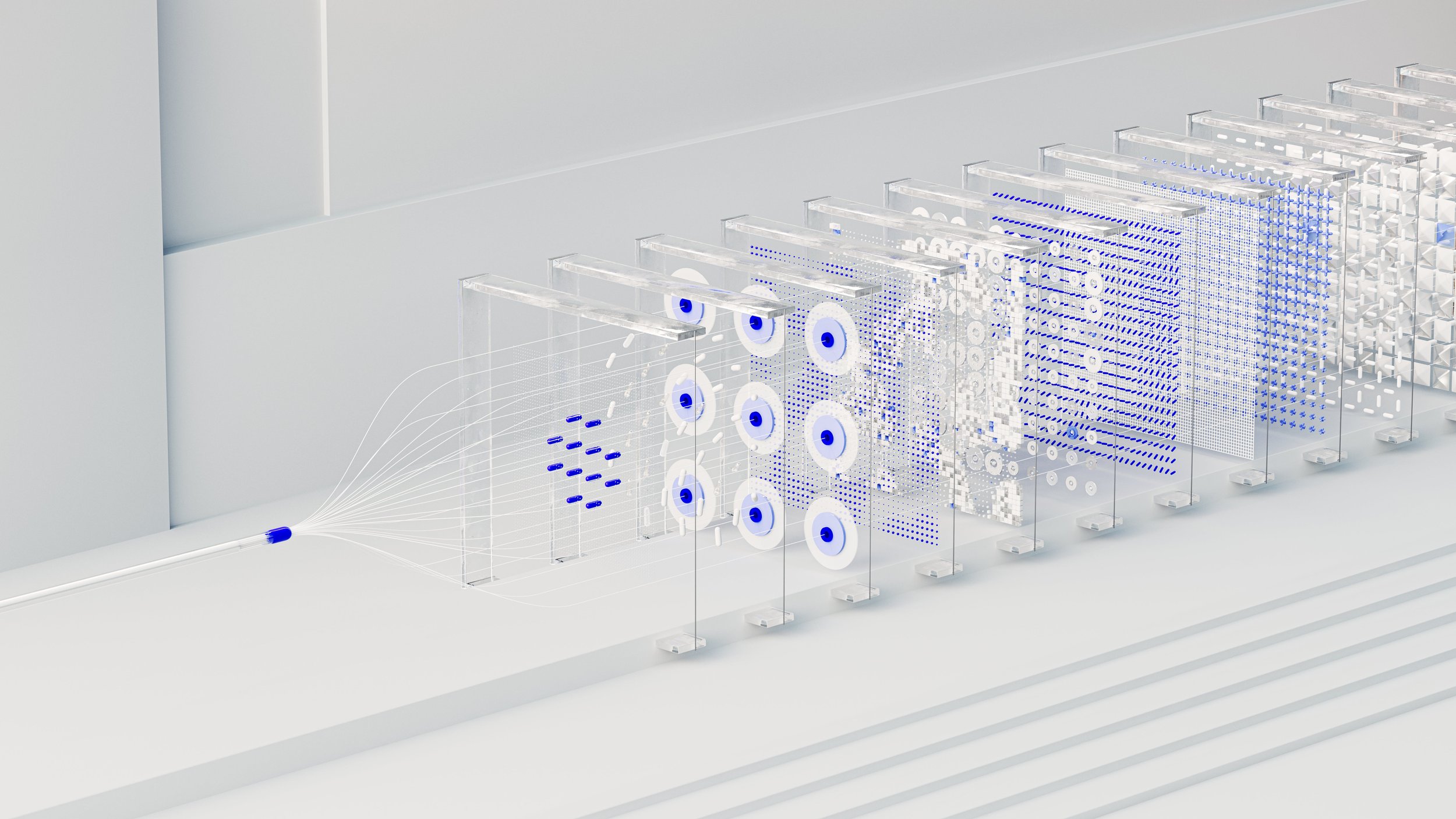

Found two important stages of a successful digital transformation journey: the Essential Transformation phase sets the stage for bringing new technologies in a safe and effective way, and the Evolutionary Transformation phase makes customer experiences significantly improved. These transformative phases may run in parallel, but the Essential Transformation is the bedrock upon which the Evolutionary Transformation builds.

The Essential Transformation

Achieving maximum value from technologies like GenAI, ML, and process automation necessitates a secure and efficient operational environment. This means having robust systems and well-trained staff ready to use these technologies. This phase, the Essential Transformation, prepares BCM companies to extract the full potential of new technologies successfully.

The Essential Transformation involves having the infrastructure to conduct seamless and secure transactions that meet customer needs. Customers, both in retail and commercial banking, expect efficient transaction processing across various channels, payment methods, and currencies. Therefore, financial organizations must modernize core banking platforms and standardize enterprise systems. This foundational work is crucial because the environment for new technologies must be equipped to leverage their benefits; otherwise, costs will spiral out of control, and business goals may remain unattained.

Mitigating risks is another essential component of the Essential Transformation stage. Companies must manage real-time risks effectively to protect their financial stability and customers. This involves optimizing risk engines, strengthening controls for operational and compliance risks, and countering cyber threats.

Throughout this phase, BCM companies must keep stakeholders informed about their transformation progress, whether internal or external, including customers, management, boards, regulators, and market analysts.

Evolutionary Transformation

In the next phase of the transformation journey, BCM companies must focus intently on understanding customers by consolidating relevant customer data and interactions into a single view. This comprehensive perspective equips banks with the critical insights to serve customer needs better. Overcoming system integration and data relevance challenges, addressed in the Essential Transformation, unlocks personalization, superior customer service, and simplified client communications.

As part of this evolution, BCM companies must prioritize delivering exceptional experiences that attract and retain customers. Leveraging available data to become more relevant, enabling seamless interactions, and offering tailored products and services at the right moment are critical aspects of this phase.

With a growing repository of customer interactions and analyzed data, information can add value by providing personalized financial advice based on a more robust understanding of individual customer circumstances.

Moreover, Evolutionary Transformation introduces "hyper-personalization," where the technology harnesses large datasets to provide a deep understanding of customer circumstances and interactions.

The second phase encourages greater collaboration through cross-industry partnerships, enabling BCM companies to leverage their strengths and resources to create new products, services, and value sources. Successful cross-industry alliances depend on the ability to share data and integrate systems to generate additional value for customers.

Looking Ahead and Completing the Transformation Journey

The advent of AI and large language models presents opportunities for companies to enhance the value they offer to customers significantly. GenAI can revolutionize customer and employee experiences, offering tailored, hyper-personalized interactions at rapid speeds. However, these technologies can also be exploited maliciously, necessitating parallel advancements in security.

In this evolving landscape, data usage will shape new analytical biases, presenting moral dilemmas for banks as they navigate the implications of what they can now discern.

BCM companies that can swiftly translate new technologies into value for customers and stakeholders will have the technical, operational, and organizational foundations needed to harness the value of rapidly advancing technologies effectively. As the banking and capital markets sector evolves, embracing digital transformation will be the key to long-term success.